4:33:55

4:33:55  2023-10-16

2023-10-16  1401

1401

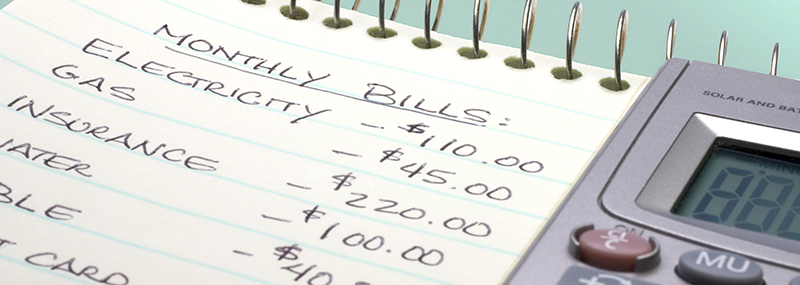

1- Set your financial goals. Understanding what you are working toward will help you build a budget to meet your needs. Do you want to pay down debt? Are you saving for a major purchase? Are you just looking to be more financially stable? Identify your top priorities so that you can build your budget to fit them.

2- Look at your overall monthly income. A smart budget is one that doesn’t overextend your means. Start by calculating your total monthly income. Include not just the money you get from work but any cash you get from things like side-hustles, alimony, or child support. If you share expenses with your partner, calculate your combined income to figure out a household budget.

3- Calculate your necessary expenses. Your first priority in building a better budget should be those things that need to be paid every month. Paying these expenses should be your first priority, as these items are not only necessary for daily activities but could also damage your credit if you fail to pay them in full and on time.

4- Factor in your non-essential expenses. Budgets work best when they reflect your daily life. Take a look at your regular, non-essential expenses, and build them into your budget so that you can anticipate your spending. If you get a coffee every morning on the way to work, for example, throw that into your budget.

5- Look for places to make cuts. Creating a budget will help you identify things you can cut from your regular expenses and roll into your savings or debt payments. Investing in a good coffee pot and a mug, for example, can help you save on your morning fix for years to come.

6- Track your monthly spending. A budget is a guideline for your overall spending habits. Your actual spending will vary each month depending upon your personal needs. Track your spending by using an expenses journal, a spreadsheet, or even a budgeting app to help you ensure that you are staying within your means each month.

7- Build some savings into your budget. Exactly how much you save will depend upon your job, your personal expenses, and your individual financial goals. Aim to save something each month, however, whether it’s $50 or $500. Keep that money in a savings account separate from your primary bank account so that it doesn't accidentally get spent.

Reality Of Islam |

|

A newly dev

Get ready f

Researchers

A new metas

9:3:43

9:3:43

2018-11-05

2018-11-05

10 benefits of Marriage in Islam

7:5:22

7:5:22

2019-04-08

2019-04-08

benefits of reciting surat yunus, hud &

9:45:7

9:45:7

2018-12-24

2018-12-24

advantages & disadvantages of divorce

11:35:12

11:35:12

2018-06-10

2018-06-10

6:0:51

6:0:51

2018-10-16

2018-10-16

7:32:24

7:32:24

2022-02-14

2022-02-14

2:5:14

2:5:14

2023-01-28

2023-01-28

9:42:16

9:42:16

2022-10-19

2022-10-19

10:55:53

10:55:53

2022-06-13

2022-06-13

12:10:56

12:10:56

2022-11-17

2022-11-17

7:6:7

7:6:7

2022-03-21

2022-03-21

7:45:39

7:45:39

2018-06-21

2018-06-21

5:41:46

5:41:46

2023-03-18

2023-03-18

| LATEST |